Running an S Corporation comes with tax advantages, limited liability, and a structure that can elevate your business to new heights. But with those benefits comes a responsibility that many business owners overlook – bookkeeping.

Get it wrong, and you risk tax penalties, shareholder disputes, and financial chaos. Get it right, and you’ll have a clear picture of your business’s financial health, make informed decisions, and maximize your tax savings.

What is an S Corporation?

An S Corporation (S Corp) is a special tax designation granted by the IRS that allows a business to pass its income, losses, deductions, and credits through to its shareholders. Unlike traditional corporations, S Corps avoid double taxation, meaning profits are only taxed at the shareholder level.

Key Benefits of an S Corp

- Pass-through taxation – Business income is reported on personal tax returns, avoiding corporate-level taxation.

- Limited liability – Shareholders’ personal assets are protected from business debts and liabilities.

- Self-employment tax savings – Owners can take a reasonable salary and reduce self-employment taxes on distributions.

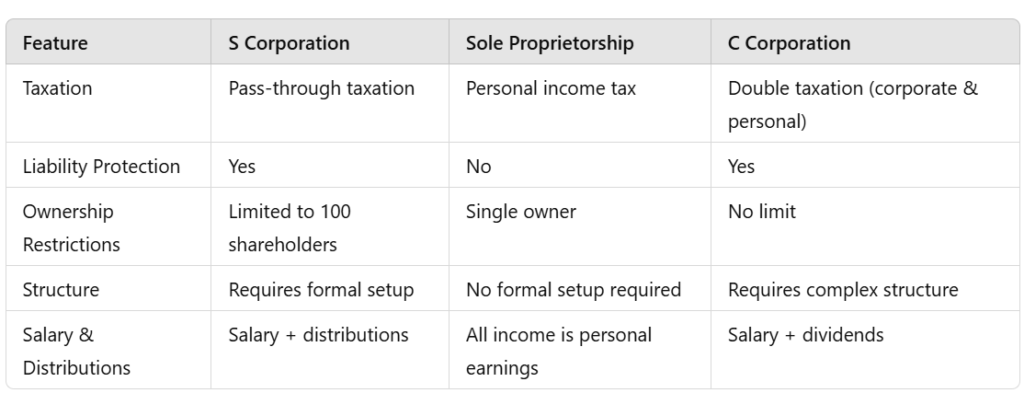

S Corps vs. Sole Proprietorships vs. C Corps

S Corps offer a balance between liability protection, tax efficiency, and operational flexibility, making them a popular choice for small business owners.

S Corp bookkeeping differs from sole proprietorships and C Corps in key ways:

- Separate entity accounting – Unlike sole proprietors, S Corps must maintain separate business finances.

- Salary vs. distributions – Owners must track both salary and shareholder distributions separately.

- Strict IRS rules – Unlike LLCs, S Corps have stricter payroll and shareholder reporting requirements.

Importance of Bookkeeping for S Corps

Ensuring Tax Compliance and Shareholder Reporting

Proper bookkeeping helps S Corps stay compliant with IRS requirements, including:

- Payroll tax filings – Ensuring reasonable compensation is reported correctly.

- Shareholder distributions – Tracking payouts to avoid tax misclassification.

- Corporate tax filings (Form 1120-S) – Keeping accurate financial records for annual returns.

Making Informed Business Decisions

Without proper bookkeeping, an S Corp can’t accurately track:

- Profitability and cash flow

- Business expenses and deductions

- Tax obligations and financial liabilities

Setting Up Your S Corp Bookkeeping System

Proper bookkeeping is the foundation of financial success for any S Corporation. Setting up an efficient bookkeeping system ensures tax compliance, accurate financial tracking, and smooth operations. Here’s a step-by-step guide to getting started.

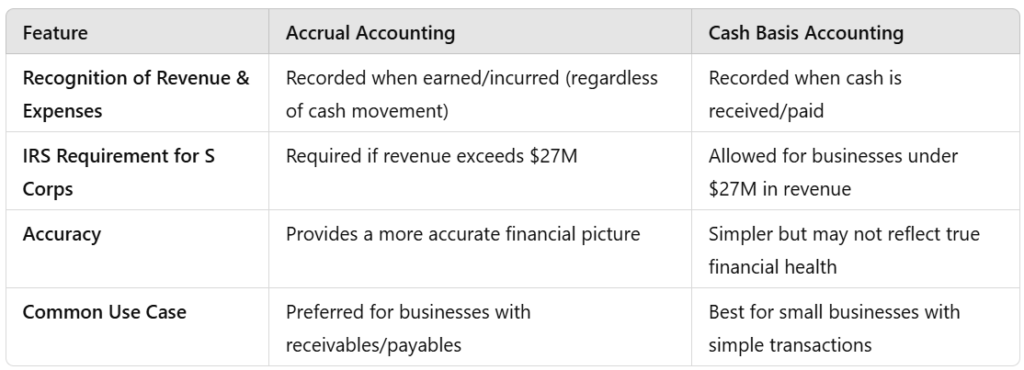

1. Choosing the Right Accounting Method

One of the first decisions you’ll need to make is selecting the appropriate accounting method. The right choice impacts how and when income and expenses are recorded.

Accrual vs. Cash Basis Accounting

Best Practice: Many S Corps opt for accrual accounting to align with IRS requirements and get a clearer view of financial health. However, small S Corps with minimal transactions may benefit from the simplicity of cash basis accounting.

Hybrid Accounting

Some businesses use a hybrid method – tracking revenue on an accrual basis while recording expenses on a cash basis. This approach provides flexibility but requires manual adjustments for tax purposes.

2. Selecting Accounting Software

The right accounting software simplifies bookkeeping, automates tasks, and ensures compliance. Here are the top options for S Corps:

Popular Software Options

QuickBooks Online – Comprehensive, user-friendly, and integrates with payroll.

Xero – Great for small teams, offers cloud-based access and automation.

FreshBooks – Best for service-based businesses with invoicing needs.

Essential Features

- Payroll Integration – Essential for tracking owner salaries and employee wages.

- Expense Tracking – Categorizes business expenses to ensure deductible items are recorded.

- Financial Reporting – Provides key reports like profit & loss (P&L), balance sheets, and cash flow statements.

- Inventory Management – If your S Corp deals with products, tracking inventory is critical.

- Cloud-Based vs. Desktop Solutions – Cloud-based software allows remote access and automatic backups, while desktop versions may offer more control over data storage.

Best Practice: Choose a scalable, cloud-based accounting solution that integrates with payroll and tax filing tools.

3. Establishing a Chart of Accounts

A Chart of Accounts (COA) is the backbone of your bookkeeping system. It categorizes all financial transactions, ensuring organized records and easy tax filing.

Why is a Chart of Accounts Important?

- Helps track income, expenses, assets, and liabilities.

- Simplifies financial reporting and tax preparation.

- Provides a clear snapshot of business performance.

Key Accounts for S Corps

Revenue Accounts – Sales income, service income, and other sources of revenue.

Cost of Goods Sold (COGS) Accounts – Direct costs related to product sales.

Expense Accounts – Includes rent, marketing, utilities, office supplies, and owner salaries (required for S Corps).

Asset Accounts – Cash, accounts receivable, inventory, equipment, and business property.

Liability Accounts – Loans, accounts payable, and taxes owed.

Equity Accounts – Shareholder capital contributions and distributions (profit withdrawals).

Best Practice: Customize your COA to reflect your business model, ensuring accurate tax deductions and shareholder reporting.

4. Setting Up Separate Bank Accounts

Keeping personal and business finances separate is critical for S Corps.

Why Separate Bank Accounts?

- IRS Compliance – Mixing personal and business expenses can trigger audits and tax penalties.

- Easier Bookkeeping – Simplifies tracking of income and expenses.

- Clear Financial Insights – Provides an accurate picture of business performance.

Recommended Accounts for an S Corp

Business Checking Account – For receiving income and paying expenses.

Business Savings Account – For tax savings and emergency funds.

Payroll Account (Optional) – Helps separate payroll from operating expenses.

Best Practice: Never use personal bank accounts for business transactions, this can cause legal and tax complications.

5. Record-Keeping Best Practices

Proper financial record-keeping ensures smooth tax filings, audit protection, and business transparency.

Digital vs. Physical Records

- Go Digital: Use cloud-based storage for easy access and security (Google Drive, Dropbox).

- Automate Backups: Schedule automatic backups to avoid data loss.

- Keep Physical Copies (Where Needed): Some tax documents and contracts may require hard copies.

Organizing Financial Documents

Bank Statements – Reconcile monthly to track cash flow.

Invoices & Receipts – Essential for expense tracking and tax deductions.

Tax Filings – Store copies of tax returns, payroll records, and Form 1120-S.

Payroll & Shareholder Payments – Keep detailed records of salaries and distributions.

Best Practice: Use accounting software with document storage to streamline record-keeping and compliance.

Essential Bookkeeping Tasks for S Corps

Once your bookkeeping system is set up, maintaining accurate financial records becomes an ongoing responsibility. S Corps have unique tax and compliance requirements, so it’s crucial to stay organized. Below are the key bookkeeping tasks that will keep your S Corp compliant and financially sound.

1. Recording Revenue and Sales

Accurate revenue tracking is essential for tax compliance and financial reporting.

Properly Documenting Sales Transactions

- Record all income sources, whether from product sales, services, or other revenue streams.

- Ensure invoices include customer details, invoice numbers, payment terms, and due dates.

- Use accounting software to automate invoice generation and track payments.

Handling Invoices, Payments, and Sales Taxes

- Invoices: Send invoices promptly and track outstanding payments.

- Payments: Reconcile payments received with bank deposits to ensure accuracy.

- Sales Taxes: If applicable, collect and remit sales tax based on state requirements.

Best Practice: Use automated invoicing tools like QuickBooks Online or Xero to streamline revenue tracking.

2. Managing Expenses

Proper expense tracking helps in budgeting, tax deductions, and financial analysis.

Documenting and Classifying Expenses Correctly

- Categorize expenses into appropriate accounts (e.g., office supplies, utilities, rent, marketing).

- Keep detailed records of business expenses, including receipts and invoices.

Tracking Deductible Expenses

Common deductible expenses for S Corps include:

- Office rent and utilities

- Business travel and meals (subject to IRS limitations)

- Software subscriptions and business tools

- Marketing and advertising costs

- Insurance premiums (health, liability, workers’ compensation)

Best Practice: Use expense-tracking software or apps like Expensify to organize receipts digitally.

3. Payroll Management

S Corps must follow IRS guidelines when paying shareholder-employees and other staff.

Reasonable Shareholder Salary

- The IRS requires S Corp owners who actively work in the business to take a reasonable salary before receiving distributions.

- Factors that determine a reasonable salary include:

- Industry standards for similar roles.

- Business profitability.

- Time spent working in the company.

Failure to take a reasonable salary may result in IRS penalties and reclassification of distributions as wages.

Payroll Tax Obligations

S Corps must withhold and pay:

- Social Security & Medicare Taxes (FICA) – 15.3% (split between employer & employee).

- Federal & State Income Taxes – Withheld from employee wages.

- Unemployment Taxes (FUTA & SUTA) – Paid by employers.

Handling Employee Benefits

- Track health insurance contributions, retirement plans (401k), and reimbursements.

- Ensure proper classification of taxable vs. non-taxable benefits.

Best Practice: Use payroll software that integrates with accounting systems to automate tax filings and salary payments.

4. Tracking Shareholder Distributions

S Corps allow tax-free distributions to shareholders, but they must be properly recorded.

Documenting Distributions Separately from Salary

- Salaries are W-2 wages, subject to payroll taxes.

- Distributions are dividends or draws, not subject to payroll taxes.

Tax Implications

- If distributions exceed basis (initial investment + retained earnings), they may be taxed as capital gains.

- The IRS closely monitors S Corps that pay high distributions but low salaries.

Maintaining Accurate Records

- Record distributions in the equity section of your Chart of Accounts.

- Keep a log of all owner withdrawals and deposits.

Best Practice: Consult a tax professional to ensure distributions are structured properly to avoid IRS scrutiny.

5. Reconciling Bank and Credit Card Accounts

Regular reconciliation ensures financial accuracy and prevents errors.

Importance of Monthly Reconciliation

- Matches transactions between your bank statements and accounting records.

- Identifies missing, duplicate, or fraudulent transactions.

- Prevents cash flow miscalculations.

Identifying and Correcting Discrepancies

- Investigate unrecorded transactions, duplicate charges, or unauthorized expenses.

- Adjust entries to reflect actual financial data.

Best Practice: Reconcile accounts monthly to avoid discrepancies piling up.

6. Inventory Management (If Applicable)

For product-based S Corps, proper inventory tracking is essential.

Tracking Inventory Levels and Valuation Methods

- FIFO (First-In, First-Out): Preferred for businesses with perishable goods.

- LIFO (Last-In, First-Out): Used in inflationary environments.

- Weighted Average: Smooths out price fluctuations over time.

Calculating COGS Accurately

COGS includes:

- Direct materials

- Direct labor

- Manufacturing overhead

Best Practice: Use inventory software like TradeGecko, Fishbowl, or QuickBooks Inventory to automate stock tracking.

7. Handling Loans and Liabilities

Properly recording liabilities ensures transparency and compliance.

Recording Loan Payments and Tracking Interest

- Separate loan principal and interest in your books.

- Interest is a deductible business expense.

Ensuring Proper Classification of Business Liabilities

- Short-Term Liabilities: Accounts payable, credit card balances, payroll taxes.

- Long-Term Liabilities: Business loans, mortgages, deferred tax liabilities.

Best Practice: Keep a clear record of loan agreements, interest rates, and payment schedules.

Financial Reporting and Analysis for S Corps

Accurate financial reporting is essential for making informed business decisions and staying compliant with IRS regulations. Regularly generating and analyzing financial statements will help you monitor performance, manage cash flow, and prepare for tax season effectively.

A. Generating Key Financial Statements

S Corps must prepare the following financial statements regularly:

1. Profit and Loss (P&L) Statement (Income Statement)

- Shows revenue, expenses, and net profit (or loss) over a specific period.

- Helps assess profitability, revenue trends, and expense management.

- Key components:

- Revenue (sales, services)

- Cost of Goods Sold (COGS)

- Gross Profit

- Operating Expenses (salaries, rent, utilities, marketing)

- Net Profit or Loss

Why It Matters: The P&L statement is used to evaluate business performance and tax liability.

2. Balance Sheet

- Provides a snapshot of assets, liabilities, and equity at a specific point in time.

- Helps measure financial stability and assess liquidity.

- Key components:

- Assets: Cash, accounts receivable, inventory, equipment.

- Liabilities: Loans, credit card balances, accounts payable.

- Equity: Shareholder contributions, retained earnings, distributions.

Why It Matters: Lenders and investors use the balance sheet to assess the financial health of the business.

3. Statement of Cash Flows

- Tracks the movement of cash in and out of the business.

- Categorizes cash activities into:

- Operating Activities: Revenue, expenses, payroll.

- Investing Activities: Equipment purchases, investments.

- Financing Activities: Loans, equity contributions, distributions.

Why It Matters: The cash flow statement helps in managing liquidity and ensuring there is enough cash for operations and growth.

Best Practice: Use accounting software like QuickBooks, Xero, or FreshBooks to generate financial statements automatically.

B. Analyzing Financial Performance

Interpreting financial statements helps in making data-driven business decisions.

Key Financial Ratios

1. Profitability Ratios: Measure how well the business generates profits.

- Gross Profit Margin: (Gross Profit / Revenue) x 100

- Net Profit Margin: (Net Profit / Revenue) x 100

2. Liquidity Ratios: Assess the ability to cover short-term liabilities.

- Current Ratio: (Current Assets / Current Liabilities)

- Quick Ratio: (Current Assets – Inventory) / Current Liabilities

3. Solvency Ratios: Evaluate long-term financial stability.

- Debt-to-Equity Ratio: (Total Liabilities / Shareholder Equity)

- Interest Coverage Ratio: (EBIT / Interest Expenses).

Identifying Trends and Areas for Improvement

- Compare monthly and yearly financial reports to track performance.

- Identify cost-saving opportunities by analyzing expense categories.

- Monitor cash flow trends to avoid shortages.

Best Practice: Use financial dashboards or reports to track KPIs and adjust strategies based on real-time data.

C. Preparing for Tax Season

S Corps have specific tax filing requirements that differ from sole proprietorships or C corporations.

Gathering Necessary Documentation

- Profit & Loss Statement – Summarizes taxable income and deductions.

- Balance Sheet – Provides financial position at year-end.

- Payroll Records – Documents salaries and payroll taxes paid.

- Shareholder Distributions Report – Tracks dividends paid.

- Business Expense Receipts & Invoices – Supports deductible expenses.

- Bank & Credit Card Statements – Verifies financial transactions.

Working with a Tax Professional

- A CPA or tax advisor ensures compliance with IRS regulations.

- Helps optimize deductions and avoid common tax mistakes.

- Provides tax planning strategies to minimize liabilities.

Filing Form 1120-S and Schedule K-1

- Form 1120-S – The tax return used by S Corps to report income, deductions, and credits.

- Schedule K-1 – Distributes income, losses, and other tax items to shareholders for personal tax filing.

Deadline: The 1120-S form is due on March 15 (or the next business day if it falls on a weekend/holiday).

Best Practice: Keep tax records organized throughout the year to ensure smooth tax filing and avoid penalties.

Common Bookkeeping Mistakes to Avoid

Even with the best systems in place, bookkeeping errors can lead to financial mismanagement, compliance issues, and costly IRS penalties. Avoid these common pitfalls to keep your S Corp’s finances accurate and organized.

1. Mixing Personal and Business Finances

- Failing to separate personal and business transactions can cause bookkeeping chaos and make tax filing difficult.

- Solution: Open a dedicated business bank account and credit card for all company transactions.

2. Neglecting Regular Reconciliations

- Skipping bank and credit card reconciliations leads to undetected errors, missing transactions, and inaccurate financial reports.

- Solution: Reconcile accounts monthly to catch discrepancies early.

3. Failing to Document Expenses Properly

- Losing receipts or not keeping records makes it difficult to claim deductions and prove expenses in case of an audit.

- Solution: Use expense tracking software or apps like Expensify to store digital copies of receipts.

4. Misclassifying Transactions

- Incorrectly categorizing expenses, revenue, or shareholder distributions can skew financial reports and impact tax deductions.

- Solution: Maintain a proper chart of accounts and review transaction categories regularly.

5. Ignoring Payroll Tax Obligations

- Failing to withhold and pay payroll taxes for employees (including shareholder salaries) can lead to IRS penalties.

- Solution: Use payroll software (Gusto, ADP, or QuickBooks Payroll) or outsource payroll processing.

6. Inadequate Record-Keeping

- Poor record-keeping leads to missing invoices, financial discrepancies, and compliance issues.

- Solution: Store financial documents securely (cloud-based or physical) and implement a consistent filing system.

7. Not Keeping Up with Changes in Tax Law

- Tax regulations change frequently, and failing to stay updated can lead to missed deductions or tax compliance issues.

- Solution: Work with a CPA or tax professional and review tax law updates annually.

When To Hire a Bookkeeper or Accountant

While DIY bookkeeping is possible, hiring a professional can save time, reduce errors, and ensure compliance.

Benefits of Outsourcing Bookkeeping

- Ensures accuracy in financial records.

- Saves time so you can focus on growing your business.

- Helps with compliance and tax preparation.

- Provides expert insights for financial decision-making.

Finding a Qualified Professional

- Look for bookkeepers/accountants with experience in S Corps.

- Consider certified professionals (CPAs, Certified Bookkeepers).

Frequently Asked Questions

- S Corps track shareholder salaries and distributions separately, as distributions are not subject to self-employment taxes.

- C Corps focus on retained earnings, corporate tax liabilities, and dividend payments, with all profits taxed at the corporate level before dividends are distributed.

You should reconcile bank and credit card accounts at least once a month to catch errors, prevent fraud, and ensure financial accuracy.

Compensation should reflect fair market value for the role performed. The IRS expects shareholder-employees to take a reasonable salary before issuing distributions. Factors include:

- Industry standards.

- Business profitability.

- Job responsibilities.

Yes, but these transactions must be properly documented:

- If reimbursed, record it as a business expense reimbursement.

- If not reimbursed, classify it as a shareholder contribution or loan to the business.

QuickBooks Online – Great for payroll, tax tracking, and automation.

Xero – Ideal for real-time collaboration and cloud accounting.

FreshBooks – Good for service-based S Corps with simple invoicing needs.

- Profit and Loss (P&L) Statement – Shows revenue, expenses, and net profit.

- Balance Sheet – Lists assets, liabilities, and equity.

- Statement of Cash Flows – Tracks cash movement in and out of the business.

- Shareholder distributions should be recorded separately from salary to avoid misclassification.

- Keep detailed records of each distribution, including dates and amounts.

- If your S Corp has complex finances, payroll, or tax obligations, hiring a bookkeeper or accountant can:

- Save time.

- Ensure compliance.

- Reduce errors.

- Many businesses start with DIY bookkeeping but switch to professionals as they grow.

- Internal controls help safeguard financial data, prevent fraud, and ensure compliance.

- Best practices include:

- Separating duties (e.g., different people handling invoicing and payments).

- Regular financial reviews and audits.

- Secure data storage for financial documents.

- Keep organized records of all transactions.

- Maintain detailed documentation for:

- Payroll.

- Shareholder distributions.

- Business expenses.

- Reconcile bank accounts and credit cards monthly.

- Ensure that shareholder salaries are reasonable and well-documented.