Whether you’re a startup founder, a nonprofit leader, or a small business owner, understanding how the double-entry bookkeeping system works will save you time, stress, and even money. If you’ve ever struggled to make sense of financial reports or wondered why your books don’t add up, this guide is for you.

What Is Double-Entry Bookkeeping?

Double-entry bookkeeping is an accounting method where every transaction affects at least two accounts, one as a debit and the other as a credit. This ensures your books always remain balanced and that your business finances accurately reflect reality. In simple terms, every dollar that moves in your business has both a source and a destination.

The Origins and Evolution of Double-Entry Bookkeeping

This system dates back to the 15th century when an Italian mathematician and Franciscan friar, Luca Pacioli, formalized the concept in his book Summa de Arithmetica.

While merchants had used similar methods for centuries, Pacioli’s documentation laid the foundation for modern accounting. Fast forward to today, and double-entry bookkeeping is the backbone of every financial system, from small businesses to multinational corporations.

Why Double-Entry Bookkeeping Matters

- Accuracy & Balance – It ensures that the accounting equation (Assets = Liabilities + Equity) always holds true.

- Error Detection – If something is off in your books, this system makes it easier to spot and correct mistakes.

- Financial Insights – It provides clear records for decision-making, tax compliance, and investor confidence.

- Scalability – As businesses grow, financial complexity increases. Double-entry bookkeeping scales with your business.

Single-Entry Vs. Double-Entry Bookkeeping

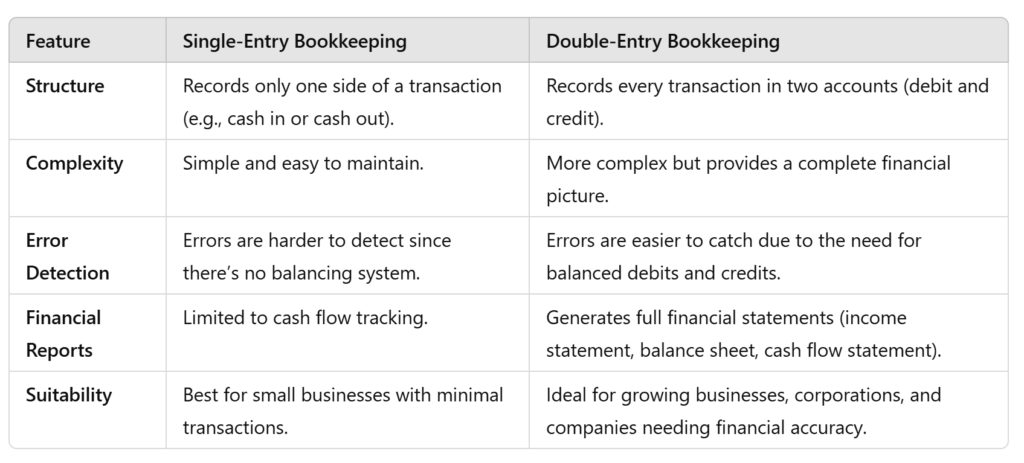

Not all businesses use double-entry bookkeeping, some opt for single-entry bookkeeping, a simpler method. However, each system serves different needs.

Situations Where Single-Entry May Be Appropriate

Single-entry bookkeeping is best for:

- Small, cash-based businesses with minimal transactions.

- Sole proprietors and freelancers who only track income and expenses.

- Self-employed individuals who don’t need full financial statements.

Example: A freelance graphic designer who tracks income from clients and expenses (like software subscriptions) may find single-entry bookkeeping sufficient.

Fundamental Principles of Double-Entry Bookkeeping

The Accounting Equation

At the core of double-entry bookkeeping is the accounting equation:

Assets = Liabilities + Equity

This equation is the foundation of all financial reporting. Every transaction recorded in a company’s books must maintain this balance.

Why This Equation Matters

- Ensures Accuracy – Every financial move in a business affects at least two accounts, keeping records balanced.

- Prevents Errors – If the equation doesn’t balance, there’s an issue that needs correction.

- Provides Insights – Business owners and investors can analyze financial statements with confidence.

For example, if a business borrows $10,000 from a bank, the cash (asset) increases by $10,000, but so does the loan (liability). The equation remains balanced.

Debits and Credits

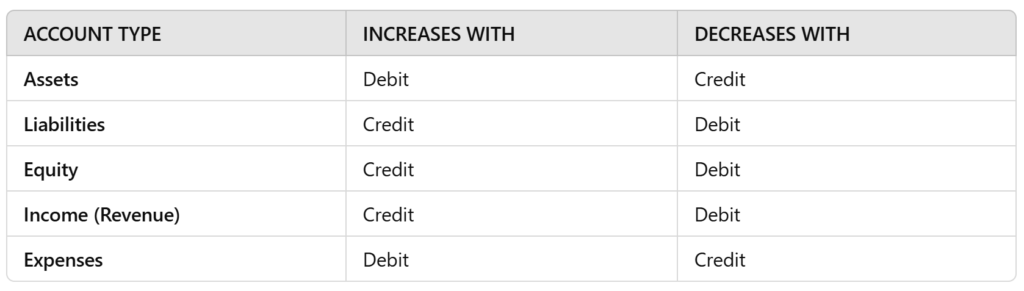

Debits and credits are the building blocks of double-entry bookkeeping. Every transaction involves at least one debit entry and one credit entry, ensuring financial records stay accurate.

- Debits (Dr.) – Represent money flowing into an account.

- Credits (Cr.) – Represent money flowing out of an account.

The key is understanding how these entries impact different types of accounts.

Rules for Different Account Types

How Debits and Credits Work in Transactions

- When a company buys equipment for cash, the equipment (asset) increases, so it’s debited, while cash (asset) decreases, so it’s credited.

- When a business earns revenue, income (revenue) increases, so it’s credited, while cash (asset) increases, so it’s debited.

Chart of Accounts

A chart of accounts (COA) is a structured list of all accounts used by a business to track financial transactions. It categorizes accounts to make bookkeeping systematic and organized.

Common Account Categories & Examples

Every business’s COA will include these five primary account types:

- Assets – Cash, Accounts Receivable, Inventory, Equipment

- Liabilities – Accounts Payable, Loans Payable, Accrued Expenses

- Equity – Retained Earnings, Common Stock, Owner’s Capital

- Revenue – Sales Revenue, Service Income, Interest Income

- Expenses – Rent, Utilities, Salaries, Office Supplies

The COA acts as a financial map, ensuring transactions are correctly classified for accurate financial reporting.

Step-by-Step Process of Double-Entry Bookkeeping

Mastering double-entry bookkeeping requires following a structured process to ensure transactions are accurately recorded and financial reports remain reliable. Below is a step-by-step breakdown of how this system works in practice.

1. Identifying and Classifying Transactions

The first step in bookkeeping is recognizing business transactions that need to be recorded.

How to Identify Business Transactions

A business transaction is any financial event that impacts a company’s accounts and can be reliably measured in monetary terms. These transactions typically fall into one of the following categories:

- Revenue – Sales of goods or services

- Expenses – Payments for rent, utilities, salaries, or supplies

- Assets – Purchases of equipment, inventory, or property

- Liabilities – Loans taken or payments made toward debts

- Equity – Investments from owners or dividend payments

Examples of Business Transactions

- A company sells products for $5,000 (Revenue)

- The business pays rent of $1,500 (Expense)

- A company purchases office furniture for $2,000 (Asset)

- A business takes a loan of $20,000 (Liability)

Once identified, transactions must be classified into appropriate account types (assets, liabilities, equity, revenue, or expenses).

2. Analyzing Transactions

Once a transaction is identified, the next step is determining how it impacts the accounting equation and which accounts are debited or credited.

Steps to Analyze a Transaction

- Determine which accounts are affected – For example, purchasing office supplies affects the Cash account and the Supplies Expense account.

- Decide if the accounts increase or decrease – Cash decreases, and Supplies Expense increases.

- Apply the debit and credit rules – Since expenses increase with debits, Supplies Expense is debited. Since assets (Cash) decrease with credits, Cash is credited.

Example Analysis

A company purchases office supplies for $500 in cash:

- Supplies Expense (Expense Account) → Debited $500 (Increase in expense)

- Cash (Asset Account) → Credited $500 (Decrease in cash)

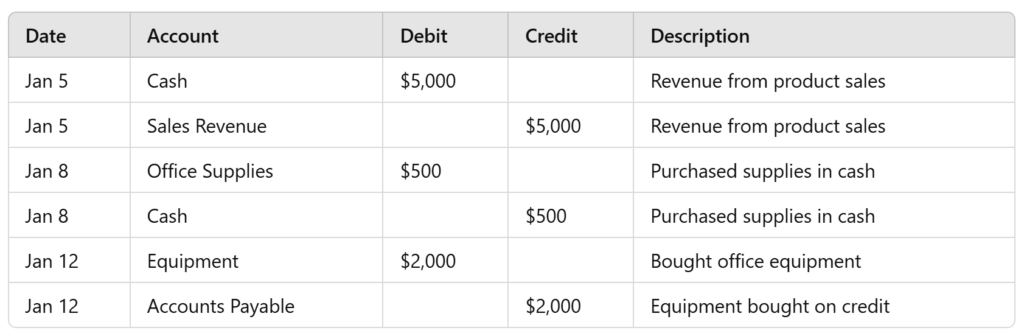

3. Journalizing Transactions

Transactions must be recorded in a journal, also known as the book of original entry. Each entry must include:

- Date of the transaction

- Accounts involved

- Amounts debited and credited

- Brief description of the transaction

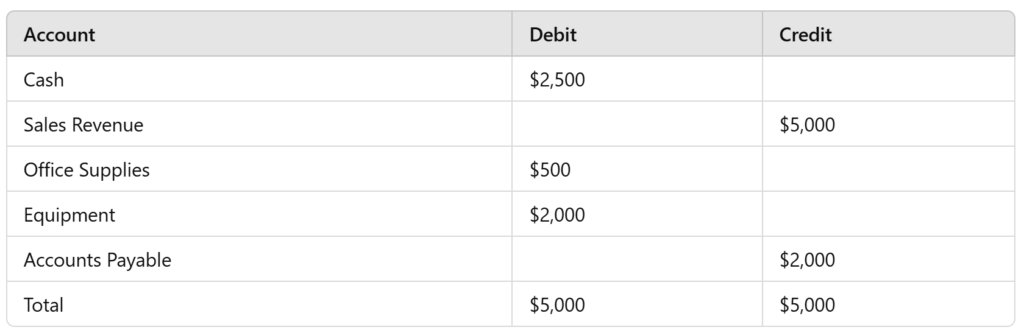

Example Journal Entries

Each transaction has a corresponding debit and credit, ensuring the accounting equation stays balanced.

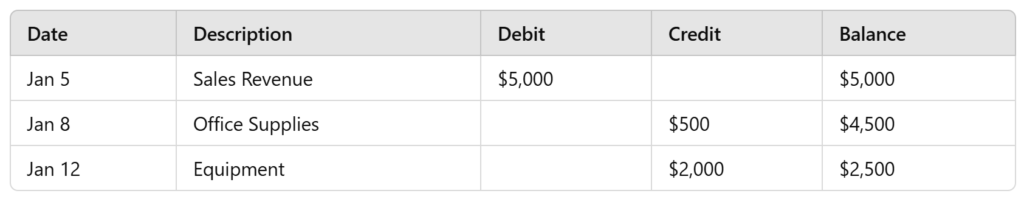

4. Posting to the Ledger

After journalizing, transactions are posted to the ledger, where they are organized by account.

What is a Ledger?

A ledger is the book where individual accounts (cash, revenue, expenses, etc.) are updated with journal entries. Every entry from the journal is transferred into the appropriate ledger accounts.

How Transactions Are Posted to the Ledger

- Debits are recorded on the left

- Credits are recorded on the right

- Each journal entry affects at least two ledger accounts

Example Ledger Entries for Cash Account

Each transaction is posted twice in the ledger, once as a debit and once as a credit in corresponding accounts.

5. Preparing a Trial Balance

Once transactions are posted to the ledger, businesses prepare a trial balance to check if total debits equal total credits.

Steps to Create a Trial Balance

- List all ledger accounts

- Record the total debit and credit balances

- Ensure total debits equal total credits

Example Trial Balance

If the trial balance does not match, an error has occurred and must be corrected.

6. Adjusting Entries

At the end of an accounting period, businesses make adjusting entries to account for:

- Depreciation – Accounting for asset wear and tear.

- Accruals – Recognizing revenues and expenses before cash changes hands.

- Prepaid Expenses – Spreading prepaid costs over time.

Example Adjusting Entry – Recording Depreciation

A company purchased equipment for $5,000, with an estimated life of 5 years. The annual depreciation expense is $1,000.

Adjusting entries help ensure accurate financial statements.

7. Preparing Financial Statements

With all entries recorded, businesses generate financial statements. The double-entry system ensures these reports are accurate.

Key Financial Statements Created

- Income Statement – Shows revenues and expenses, determining net profit or loss.

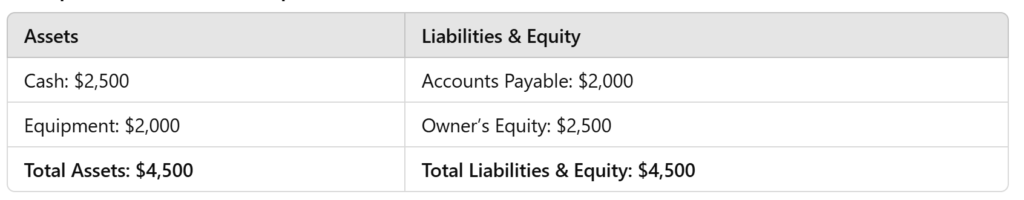

- Balance Sheet – Displays assets, liabilities, and equity.

- Cash Flow Statement – Tracks cash inflows and outflows.

Example: Balance Sheet

Since double-entry bookkeeping ensures accurate recording, financial statements always balance.

Advantages of Double-Entry Bookkeeping

1. Accuracy and Reliability

- Minimizes Errors: Double-entry bookkeeping reduces the risk of misstatements in financial records by requiring each transaction to be recorded as a debit and a credit.

- Ensures Balance: Since the accounting equation (Assets = Liabilities + Equity) must always remain balanced, discrepancies are easier to identify.

Example:

If a business forgets to record the credit side of a transaction, the trial balance will not match, signaling an error.

2. Error and Fraud Detection

- Identifies Discrepancies: The dual-recording system makes it easier to catch missing, duplicate, or incorrect entries.

- Prevents Fraud: If someone tries to manipulate records, the corresponding entry must also be changed, making fraud easier to detect and investigate.

Example:

A business notices that cash payments are recorded but there’s no corresponding expense entry, this could indicate theft or improper recording.

3. Facilitation of Financial Reporting and Analysis

- Accurate Financial Insights: A structured ledger ensures that revenues, expenses, assets, and liabilities are clearly documented.

- Better Business Insights: Stakeholders, investors, and management can analyze trends, cash flow, and profitability based on clear records.

Example:

A business tracking its inventory purchases can easily determine how much it spends on stock versus how much revenue it generates from sales.

4. Compliance with Accounting Standards

- Meets Legal and Regulatory Requirements: Double-entry bookkeeping is the standard under GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards).

- Avoids Legal Issues: Ensuring that financial statements meet regulatory requirements reduces the risk of penalties or compliance violations.

Example:

A publicly traded company must follow GAAP/IFRS rules when reporting financial statements to maintain investor confidence and avoid regulatory fines.

5. Better Business Decision-Making

- Informed Financial Planning: Accurate records allow businesses to budget, forecast, and plan for growth effectively.

- Identifies Strengths and Weaknesses: Owners can assess where they are spending too much or where profit margins are highest.

Example:

A business sees that marketing expenses are increasing but sales remain flat. This could indicate the need to adjust marketing strategies.

6. Comprehensive Financial Profile

- Tracks the Full Impact of Transactions: Every transaction affects at least two accounts, offering a complete view of how money flows in and out.

- Ensures Transparency: Businesses can see exactly where revenue comes from and where expenses go.

Example:

A company that pays off debt will see a decrease in cash (asset) and a decrease in liabilities, providing a clear financial picture.

7. Simpler Recording of Transactions Over Time

- Creates a Logical Accounting Flow: Once a business has a structured chart of accounts, transactions can be easily categorized and recorded.

- Reduces Manual Corrections: Since errors are easier to catch, businesses spend less time fixing mistakes.

Example:

Instead of sifting through scattered records, a business can pull a general ledger and instantly see all transactions related to a specific account.

8. Simplified Financial Statements

- Makes Statement Preparation Easier: Because transactions are already categorized, generating income statements, balance sheets, and cash flow statements is more efficient.

- Supports Audit Readiness: Auditors and financial professionals can trace entries back to their sources, making audits smoother.

Example:

A company preparing its annual financial report can generate reports directly from its accounting system without manually reconciling accounts.

Common Double-Entry Bookkeeping Challenges and How to Overcome Them

While double-entry bookkeeping is essential for accuracy and financial control, it comes with challenges, especially for small businesses and startups. Getting to understand these difficulties and knowing how to address them can streamline the process and improve financial management.

1. Complexity for Small Businesses

Small business owners often find double-entry bookkeeping overwhelming, especially if they lack accounting knowledge. Recording every transaction in two accounts may seem time-consuming compared to single-entry bookkeeping.

How to Overcome It:

- Use simplified accounting software that automates double-entry transactions.

- Create a clear chart of accounts to keep financial categories organized.

- Start with basic transactions (e.g., income, expenses) before expanding to more complex entries.

- Consider outsourcing bookkeeping to a professional bookkeeper or accountant.

2. Initial Setup and Training Needs

Setting up a proper accounting system requires initial effort and learning, which can be intimidating for businesses transitioning from informal record-keeping.

How to Overcome It:

- Choose user-friendly accounting software with built-in tutorials.

- Invest in basic bookkeeping training for business owners and employees.

- Work with an accounting professional to set up the initial chart of accounts and financial system.

- Follow step-by-step bookkeeping guides to ensure correct implementation.

3. Maintaining Consistency and Accuracy

Errors, inconsistencies, or missing transactions can disrupt financial records, leading to inaccurate reports and tax issues.

How to Overcome It:

- Implement a daily or weekly bookkeeping routine to record transactions regularly.

- Use accounting software with automated reconciliation to flag mismatched entries.

- Conduct monthly trial balance reviews to catch discrepancies early.

- Store all financial documents (receipts, invoices, statements) in a digital or physical filing system for reference.

Transitioning from Single-Entry to Double-Entry

As businesses grow, switching to double-entry bookkeeping becomes necessary for better financial management.

How to Upgrade:

- Set Up a Chart of Accounts: Define asset, liability, equity, income, and expense accounts.

- Use Accounting Software: Tools like QuickBooks, Xero, or FreshBooks automate double-entry recording.

- Record Opening Balances: Convert existing single-entry records into a structured double-entry system.

- Adopt Journals and Ledgers: Start recording transactions with proper debit and credit entries.

- Seek Professional Help: Consult a bookkeeper or accountant to ensure a smooth transition.

Example: A small bakery using single-entry bookkeeping expands to multiple locations and needs accurate inventory tracking. By switching to double-entry, it can properly manage costs, revenue, and financial reports.

Mastering this system will set your business up for long-term success, financial clarity, and sustainable growth.

Frequently Asked Questions

Double-entry bookkeeping is an accounting method that records every transaction in at least two accounts, one as a debit and the other as a credit. This system ensures that for every financial activity, we track both where the money is coming from and where it is going.

For example, if you purchase office supplies for $500 using your business bank account:

- Office Supplies (Expense) → Debit $500 (Increase in expenses)

- Bank Account (Asset) → Credit $500 (Decrease in assets)

This system helps businesses maintain accuracy, prevent fraud, and generate reliable financial statements.

Double-entry bookkeeping is crucial for financial accuracy and compliance. Here’s why:

- Prepares essential financial statements – Balance sheets, income statements, and cash flow statements rely on accurate bookkeeping.

- Tracks financial health – It helps businesses understand their financial position at any given time.

- Prevents errors – Since every transaction affects two accounts, the system automatically cross-checks itself.

- Ensures compliance – It aligns with accounting standards like GAAP and IFRS, required for tax reporting and audits.

Without double-entry bookkeeping, businesses risk inaccurate reporting, financial mismanagement, and potential legal issues.

Every financial transaction falls into one of these five categories:

- Assets – What a business owns (cash, inventory, equipment, accounts receivable).

- Liabilities – What a business owes (loans, accounts payable, taxes due).

- Equity – Owner’s investment in the business (retained earnings, stock).

- Income (Revenue) – Money earned from sales or services.

- Expenses – Costs of running the business (rent, salaries, utilities).

By tracking these, businesses keep their finances organized and make informed decisions.

A chart of accounts (COA) is a structured list of all the accounts a business uses to record financial transactions. Think of it as the blueprint for organizing financial data.

A typical COA includes:

- Asset accounts (Cash, Accounts Receivable, Inventory)

- Liability accounts (Loans Payable, Accounts Payable)

- Equity accounts (Owner’s Capital, Retained Earnings)

- Income accounts (Sales Revenue, Service Income)

- Expense accounts (Rent, Utilities, Advertising)

Each account is assigned a unique number for easy tracking in the bookkeeping system.

A journal is the first place transactions are recorded before they move to the ledger.

Think of it as a financial diary where transactions are entered in chronological order.

For example, a journal entry for a $1,000 client payment might look like this:

- Cash (Asset) → Debit $1,000

- Accounts Receivable (Asset) → Credit $1,000

Journals help ensure that transactions are documented accurately and in real-time before they are posted to the ledger.

A ledger is where transactions are categorized into specific accounts.

While the journal records transactions in order of occurrence, the ledger organizes them by account type.

For instance, if you receive multiple payments from customers, each one will be logged in the Cash account in the ledger, showing an updated balance.

Each ledger account has:

- A debit (left side)

- A credit (right side)

This organization helps businesses track their financial position with clarity.

- Debits increase asset accounts (e.g., adding money to your bank account).

- Credits decrease asset accounts (e.g., withdrawing money or making a purchase).

Example: Buying a $2,000 laptop using business funds

- Equipment (Asset) → Debit $2,000

- Bank Account (Asset) → Credit $2,000

- Debits decrease liability accounts (e.g., making a loan payment).

- Credits increase liability accounts (e.g., taking out a new loan).

Example: Taking out a $10,000 business loan

- Cash (Asset) → Debit $10,000

- Loan Payable (Liability) → Credit $10,000

A trial balance is a financial statement that ensures total debits equal total credits.

Why is it important?

- Detects bookkeeping errors before financial reports are generated.

- Confirms the accuracy of ledgers before preparing statements.

- Helps businesses catch discrepancies before filing taxes.

If the trial balance doesn’t match, an error has occurred, such as an incorrect journal entry or missing transaction.

The accounting equation is:

Assets = Liabilities + Equity

Every transaction in double-entry bookkeeping keeps this equation balanced.

For example, if a company secures a $5,000 bank loan, the transaction affects:

- Assets (Cash) → Increases by $5,000 (Debit)

- Liabilities (Loan Payable) → Increases by $5,000 (Credit)

Because the increase in cash is offset by an increase in liabilities, the equation remains balanced.

To ensure that your financial data remains private and secure, here are a few steps:

- Choose a Provider with Compliance: Look for bookkeeping services that are compliant with major data privacy laws, such as GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act).

- Review Security Policies: Before signing a contract, request the provider’s security policies to understand how they protect your data and ensure compliance with privacy laws.

- Secure Data Access: Ensure that data is stored and transmitted securely, using encryption and secure cloud platforms with multi-factor authentication to limit access to authorized individuals only.

Choosing a provider that prioritizes data security and privacy ensures your business remains protected from potential breaches or misuse of sensitive financial data.